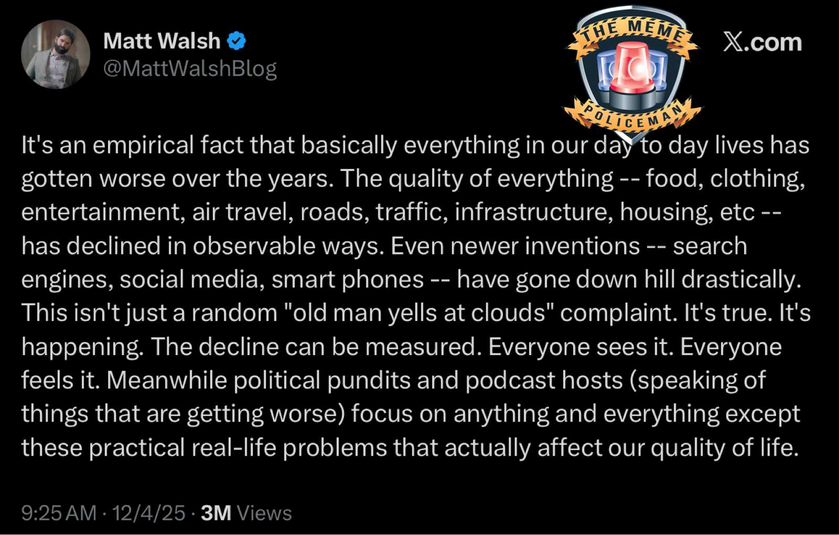

This galaxy take on student loans tries to convince us that loan forgiveness is “not actually costing anyone any money.” It received a disturbing amount of likes and shares, which means it’s being taken seriously, so here’s the breakdown.

▪️It begins by giving a hypothetical scenario where the lender is charging a 365% interest rate, which is well into loan shark territory. In this scenario, yes the lender could still profit despite forgiving some of the interest accrued, but student loans avg around 7% interest, entirely different.

▪️All money for Federal student loans originates from the US Treasury, which is then sent to the Dept of Education and then to students. Congress appropriates this money each year. It is funded through federal tax dollars (or borrowing) and absolutely costs money.

▪️When recipients repay their loan, this is sent back to the US Treasury (via a student loan servicer middleman). Ostensibly, this would repay the initial taxpayer money sent out, if everyone repaid their loans. If the loans are forgiven, the US Treasury takes the hit.

▪️Pretending it’s not costing money because interest accumulates is nonsensical. In the meme’s hypothetical scenario of 365% interest, yes. But at 7% interest, when the CPI is currently above 8%, the government (i.e. taxpayer) is already losing on the loans.

▪️And that’s if everyone was paying and there were zero costs associated with administering the loans. But people aren’t paying (there’s still a moratorium), there are always defaults, and there are administrative costs.

▪️Plus, not only is $10K per borrower being forgiven, Biden’s order also changes the income-based debt repayment program (IDR) to cap payments at 5% of discretionary income (income exceeding 225% of the poverty line).

▪️Thus, an individual making $75K/yr would only be responsible for $2,221/yr ($185/month) whether they borrowed $20K or $200K. And after 20 years (now sometimes only 10 years) the remaining loan balance is forgiven (i.e. absorbed by the US Treasury).

▪️The result is this will cost a lot of actual money. The Wharton School estimates ~$500B over 10 years, but the real impact could be the changes to the IDR, which could easily cost over $1T as new borrowers change their behavior (take on even more loans).

https://budgetmodel.wharton.upenn.edu/issues/2022/8/26/biden-student-loan-forgiveness

▪️This meme is correct on one aspect, your taxes aren’t paying for loan forgiveness, because the government isn’t adding new taxes to pay for it. It will simply add to the debt, which will be paid by future taxpayers and/or through inflation. But it will certainly cost someone actual money.

So many of these right wing accounts are just whiners now, this is a diatribe about automatic sinks and towels, the horror! As I explained in a prior post, most of the newer terminals have great bathrooms, some now have completely private stalls and plenty of them. The worst and most crowded airport bathrooms are invariably found in aging terminals that are decades old. It’s a reminder that airports were usually drab and uncomfortable.

I think the heyday of the air hand-dryers was like 15-20 years ago, where often you couldn’t find real towels. Now you can at least usually get real paper towels in airport bathrooms. Remember those old cloth roller towels that would go in a loop and somehow “clean” themselves? Yuck! Public bathrooms have always been gross, it seems some are deliberately having selective memories.

Airport food and drinks were always expensive, but now practically everyone brings those huge cooler flasks with them and fills them up. So not sure what he means that ...

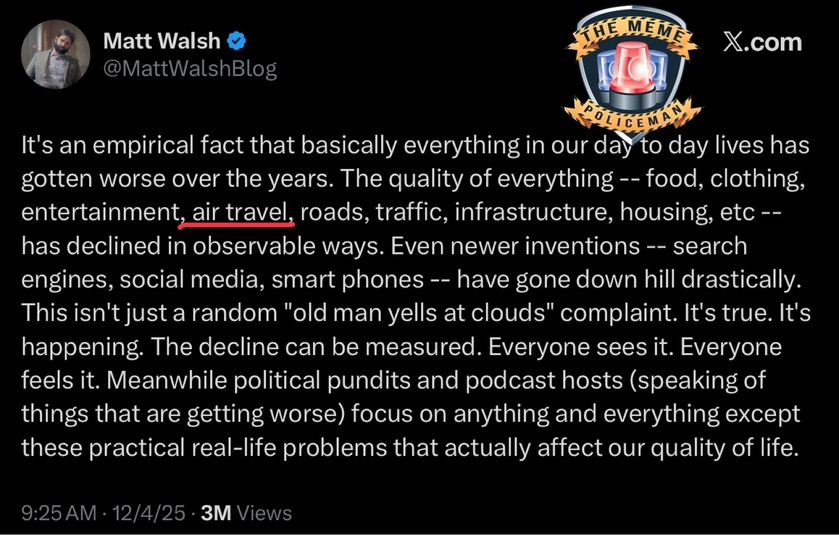

I first critiqued this terrible take by looking at how food has actually improved substantially. Even though I said the same could be done in every category, people said “you’re only doing food.” So let’s do air travel and see why it’s not gotten better, not worse.

▪️Aircraft have greatly improved. Just 15-20 years ago, many domestic routes (~15%) were flown by turboprops like the Brasilia, Dash 8 or Saab. Now, almost everything is in jets, and most aircraft have WiFi. Some even have Starlink, where you probably have faster WiFi than your home. Most major airlines offer dozens or hundreds of movies and shows to watch.

▪️Newer designs like the 787 have lower cabin altitudes and improved humidity, which make a huge difference in passenger comfort on long haul flights. The first/business class international market has gotten very competitive globally, with many carriers offering excellent service and amenities. Pods, suites, showers, etc. Coach still sucks but is dramatically cheaper ...

This is the complete opposite of an empirical fact. The right has now joined the left in being pessimistic about the modern world and completely unappreciative of the amazing abundance we now have. I’ll just focus on food here, but you could do it for almost every category.

▪️Fresh produce used to be available only in season. In the winter it was canned or frozen. People used to send fruit for Christmas gifts, it was that much of a luxury good. Now, you can get giant, sweet berries year around in every grocery store. Corn on the cob in February. Not to mention once rare items like dragon fruit, heirloom tomatoes or baby bok choy.

▪️If you didn’t live on the coast, seafood was either not available, frozen, or extremely expensive. If you lived in the Midwest and traveled to coastal locales you would quite literally be able to eat food you had never seen. Salmon has become much more abundant and accessible. You can get fresh ahi at Walmart today. Sushi and oyster bars exist everywhere ...